Financial planning is a simple but crucial thing that must be owned and carried out by every Micro, Small and Medium Enterprise (MSMEs) actor. Financial planning is achieving one’s life goals through integrated and planned financial management.

“This financial planning has a variety of significant benefits for Mr / Ms MSMEs. The benefits of financial planning include productive assets, achieving and maintaining well-being, providing confidence in financial decisions and financial planning, entrepreneurs achieving goals, and minimizing financial risks,” said Ikhwan, a Postgraduate Student at the Faculty of Administrative Sciences, University of Indonesia (FIA UI).

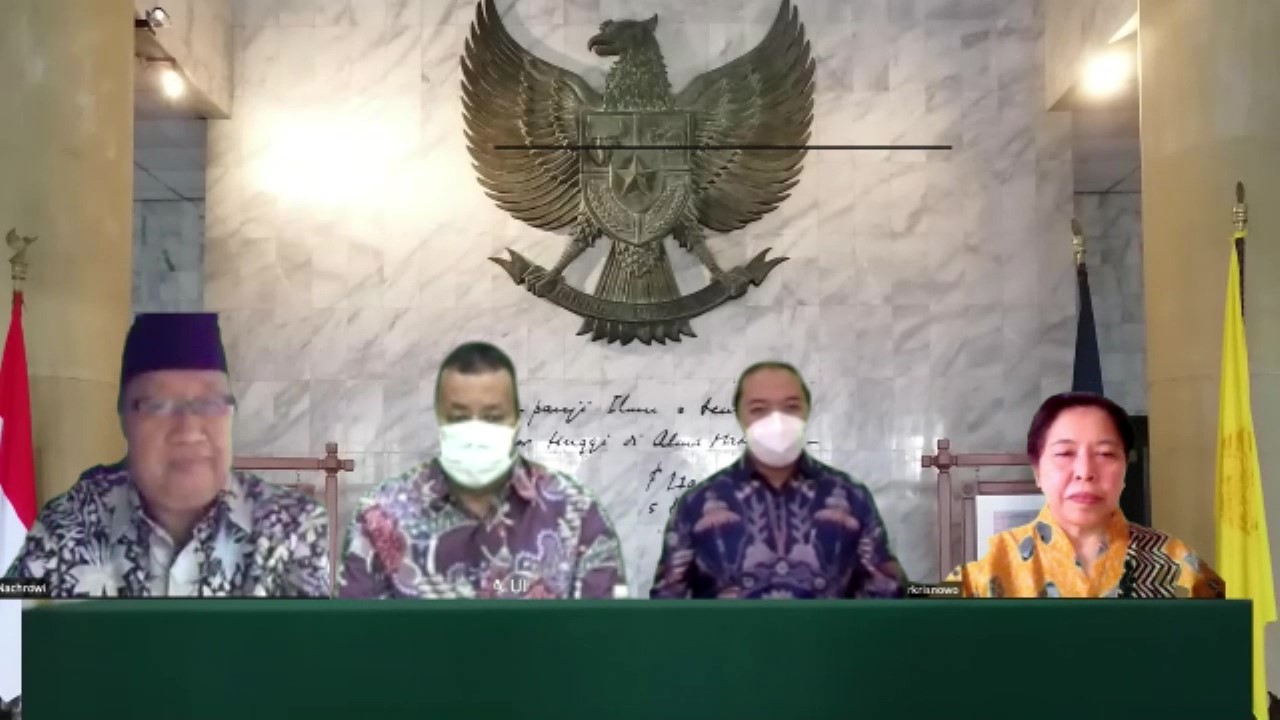

Ikhwan explained this in the community service organized by the Faculty of Administrative Sciences, the University of Indonesia, in a triple helix collaboration: Depok City Government, BJB Bank, Indonesian Classification Bureau, and Madani National Capital. This Community Service activity took place on Monday, December 6, 2022 in the Floating Room at the University of Indonesia. Dr. Andreo Wahyudi Atmoko chaired this event with Satrio Budi Adi, SE, M.Si, as FIA UI lecturers.

Andreo said that this program was a step to help MSME actors in Depok City survive and even develop amid the onslaught of national economic problems. He hopes that this Pengmas event can help MSME actors to be able to make financial planning properly.

Furthermore, Ikhwan explained that the principles of financial planning include the discipline of financial recording, separating personal and business finances, having reserve funds, making a budget vs actual, making priorities, making the best standard and worst scenarios for business, diversification and business expansion,

“Late payments, lack of financial literacy, overestimated sales estimates, and not keeping cash reserves are the biggest challenges in cash flow and finance that MSME players commonly face. Therefore, a strategy is needed to manage business cash flow, namely doing proper financial planning, prioritizing payments up front, making sure cash in is greater than cash out, separating personal and business accounts, doing it with a strong commitment, allocating profits well, and lastly make a cash flow report carefully,” added Reza.

Not only regarding financial planning, in this Community Service the MSME actors who attended were assisted in Simple Bookkeeping and Recording for MSMEs. MSMEs in managing a business, said Reza, must be able to manage finances by making notes on every receipt and disbursement of money, buying and selling of goods. Records are made to know how much business profit and how many sales are obtained.

“Bookkeeping for MSME actors can be useful in being able to convey useful information for business planning, knowing the financial position of a business, providing an overview of the company’s balance sheet, facilitating the calculation of business taxes that need to be reported, and providing data information regarding business performance. To make a business report or business that you run, follow these steps: to record all transactions that occur in your business, collect proof of transactions, and don’t forget to make your financial reports,” said Reza from FIA UI, closing the discussion session.

This Community Service event for Depok UMKM was closed with assistance in the Implementation of Accounting in the SI APIK Application (Financial Information Recording Application). Please note 70 Depok MSME actors attended this event. FIA UI is working with the Depok City Government to provide financial assistance to Depok City MSMEs. Service in the form of explanations and help to MSME actors for financial planning, bookkeeping, and recording of MSME finances and assets in Depok City.