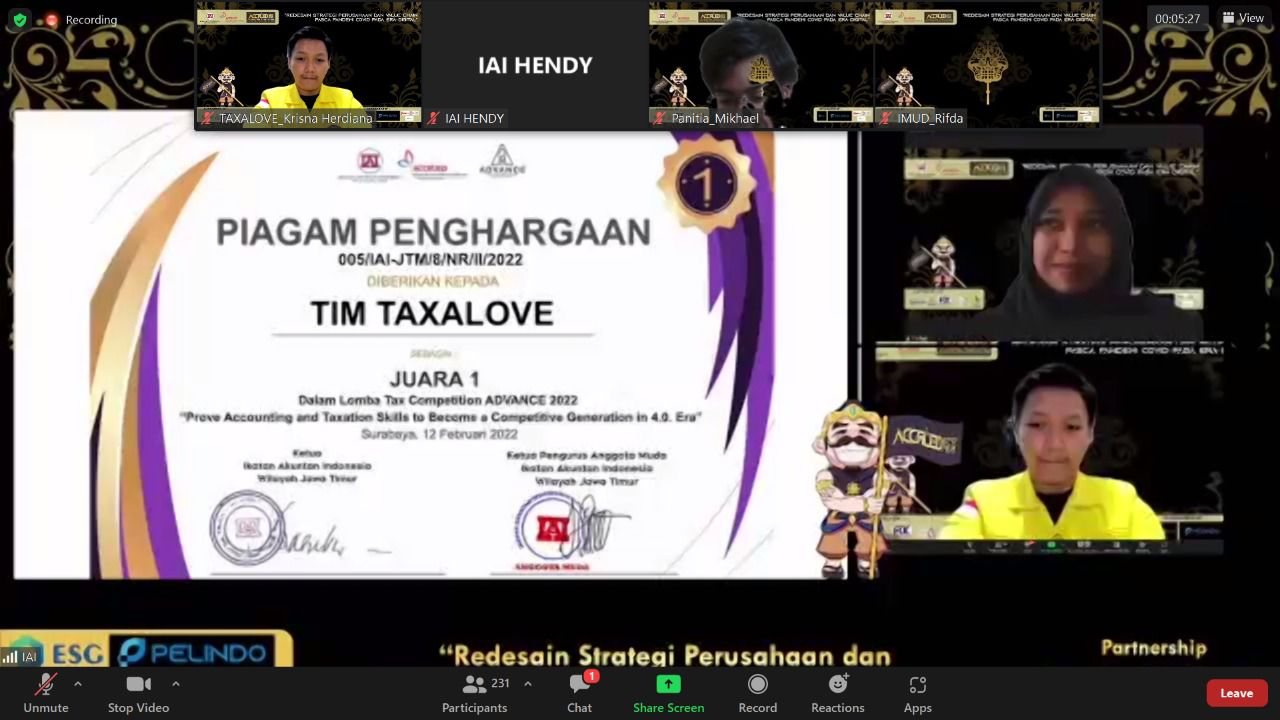

The Faculty of Administrative Sciences, University of Indonesia (FIA UI) is again proud of the achievements made by the Taxalove Team consisting of DIAF students in the “Accounting Due Verability and Tax Competition 2022 (Advance 2022)” competition organized by the Indonesian Institute of Accountants (IAI) East Java.

The team consisting of Zakky Ashidiqi (2020), Tiara Ananda Eka Putri (2018), and Krisna Herdiana (2020) was able to win 1st Place in the competition themed “Prove Accounting and Taxation Skills to Become a Competitive Generation in 4.0. that era. “Alhamdulillah, after a long journey, I was able to become the 1st place winner,” said Zakky.

This competition does not only discuss intellectual abilities in debating, but also in the speed and accuracy of problem solving, and of course great teamwork. The competition has several stages starting from the Pre Eliminary competition by working on 100 questions in groups. Then proceed to the preliminary round which was participated by the 35 best teams consisting of 2 rounds: the first round 30 questions that were done individually and 1 case study question for the SPT 1771 Agency.

“Then the 12 best teams are entitled to take part in the semifinals, the semifinals consist of 2 rounds as well as 3 mandatory questions which are directly asked by the jury and answered by each participant and a quiz round with a 16 box system, 4 teams with the highest accumulations are entitled to enter to the final round (Claim Your Achievement) debate on taxation issues,” explained Zakky.

When entering the final round, namely the debate on the debate on the first tax issue, the Taxalove Team raised the topic “Does the Current PTKP Threshold Reflect the Principle of Justice? These three great students have the view that the current regulations regarding PTKP still cannot accommodate the principle of vertical justice from the perspective of taxpayers considering that There are significant differences in household expenditure data for each province, which is why the three of them brought up the topic.

Then the three of them entered the Grand Final round and raised the theme “Readiness of the Directorate General of Taxes and Taxpayers in welcoming the era of information disclosure”. These three talented youths argue that the principle of information disclosure is one component in realizing good governance.

“Openness of public information is an important part of the implementation of public services is also a very important and strategic right for citizens to get access to other rights, because how is it possible to get other rights and services properly if the information obtained about the rights of This is not obtained precisely and accurately, “explained Zakky.

Through this competition, these three talented FIA students were able to learn new things such as prudence in the interpretation of every sentence of the law, the importance of the principle of tax equity (tax equity) in the formulation of tax policies, as well as careful calculations between benefits and cost administration in policy formulation.

This victory was unexpected by these three great students. Because they have a pretty tough challenge in the face of the competition. Namely health conditions, busyness, and difficulty equalizing discussion time. However, in the midst of these challenges, they were able to strengthen and comfort each other to be able to continue fighting until the end.